Unlike simple moving averages, where all numbers are assigned an equal weighting, weighted moving averages give a heavier weighting to more recent data points as they are more relevant than past data points. SMA = $15.74 Weighted Moving Average (WMA) For example, the closing prices for stock X for the previous five days are as follows: $15, $15.5, $16, $15.7, and $16.5. Let’s imagine you want to calculate the simple moving average for stock X by looking at the stock’s closing prices for the last five days. N = number of time periods Example simple moving average calculation The formula for calculating SMA is as follows: SMA formula.

Each data point is weighted equally in the SMA, regardless of whether it happened yesterday or a month ago.

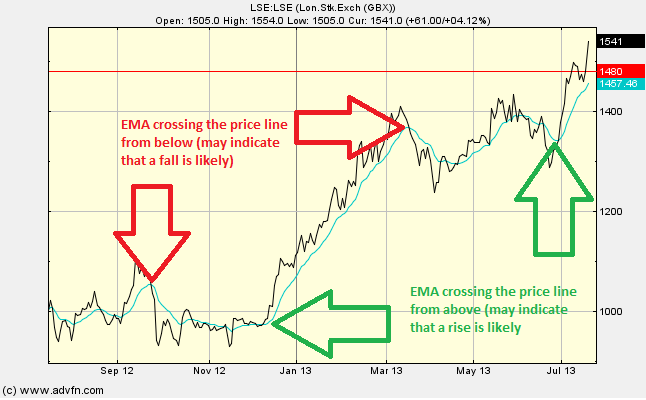

Old data is eliminated as new data becomes available, causing the average to move along the time scale. As the name suggests, a moving average is an average that moves. A simple moving average is typically based on daily closing prices but can also be calculated for other timeframes, such as the opening or median price.įor instance, a 10-day simple moving average is the ten-day sum of closing prices divided by ten. Simple moving average (SMA)Ī simple moving average is calculated by summing recent prices in a given data set and then dividing that figure by the number of time periods in that set. There are three primary types of moving averages: Simple moving average (SMA), weighted moving average (WMA), and exponential moving average (EMA). Top 6 Real Estate Investing Books for Beginners.15 Highest-Rated Crypto Books for Beginners.10 Best Stock Trading Books for Beginners.

#Ema meaning in stocks how to#

0 kommentar(er)

0 kommentar(er)